11 | Add to Reading ListSource URL: eparc.missouri.eduLanguage: English - Date: 2016-07-14 15:07:07

|

|---|

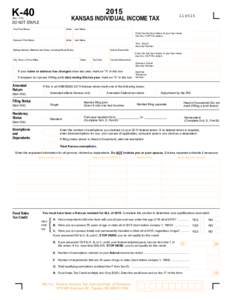

12 | Add to Reading ListSource URL: ksrevenue.orgLanguage: English - Date: 2015-11-05 16:23:21

|

|---|

13 | Add to Reading ListSource URL: www.sonomacalfresh.orgLanguage: English - Date: 2015-10-23 10:31:30

|

|---|

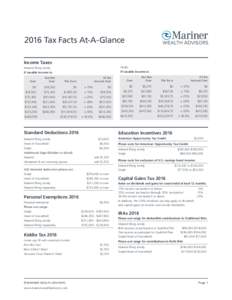

14 | Add to Reading ListSource URL: www.marinerwealthadvisors.comLanguage: English - Date: 2016-03-06 21:33:12

|

|---|

15 | Add to Reading ListSource URL: ustrust.comLanguage: English - Date: 2015-12-15 11:53:45

|

|---|

16 | Add to Reading ListSource URL: www.ksrevenue.orgLanguage: English - Date: 2015-11-05 16:23:21

|

|---|

17 | Add to Reading ListSource URL: d2kje4aw0lzm6i.cloudfront.netLanguage: English - Date: 2015-09-29 16:25:51

|

|---|

18 | Add to Reading ListSource URL: webserver.rilin.state.ri.usLanguage: English - Date: 2015-02-05 11:45:09

|

|---|

19 | Add to Reading ListSource URL: www.skatteetaten.noLanguage: English - Date: 2013-05-10 06:58:47

|

|---|

20 | Add to Reading ListSource URL: www.revenue.delaware.govLanguage: English - Date: 2015-02-11 12:55:43

|

|---|